Your Equity Could Change Everything About Your Next Move

.

.

A lot of people are asking the same thing right now: “Is it even a good time to sell?” And the truth may come as a bit of a surprise…

For many homeowners, the answer is a strong yes.

Why? Because of one major factor working in your favor: your equity. Odds are, if you’ve lived in your home for a while, you know you have significant equity. But how much are we really talking about? The number might just change everything about your next move.

The Hidden Wealth of Homeownership

Here’s how it works. When you own a home, you build up something called equity.

Each time you make a mortgage payment, you’re chipping away at your loan balance. And that helps your ownership stake in your home grow. At the same time, home values typically rise – which drives up the overall value of your home.

When you put those two things together, you’re building wealth automatically, month after month, year after year.

And that combo can add up to real dollars that can make a real difference in your move. That’s especially true if you’ve lived in your house for a while, which many homeowners have. According to Realtor.com:

“Nearly half (45.2%) of today’s homeowners have lived in their home for more than 15 years, and 1 in 4 for over 25 years.”

If that’s you, just imagine what 15-25 years of payments + steady appreciation have done to your bottom line. It’s time you see how your equity stacks up over time.

What That Really Means in Dollars

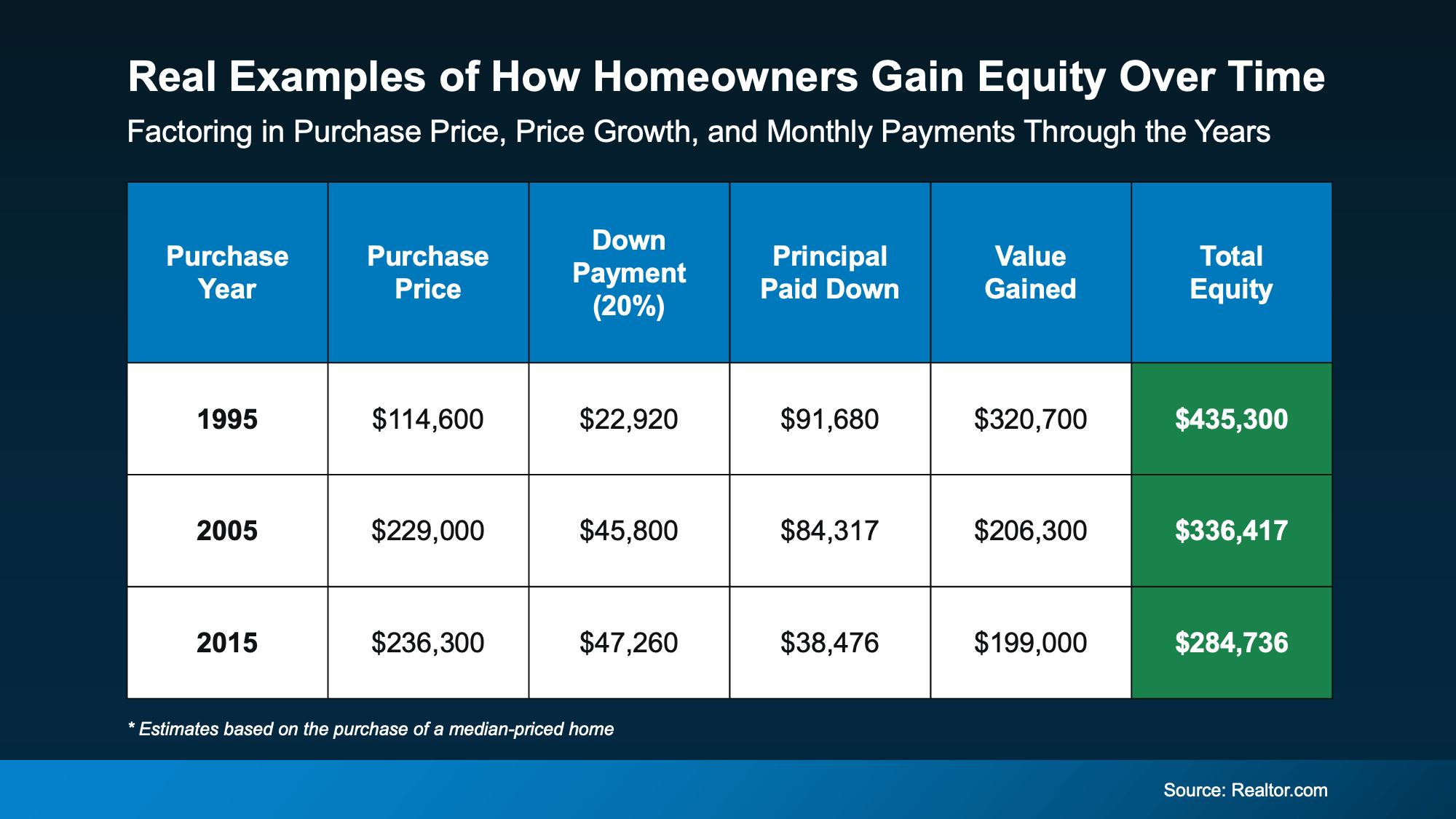

This chart uses research coming out of Realtor.com to show an estimate of how much equity homeowners have built up depending on when they bought. For each time frame, it takes the median-priced home and uses it as the baseline example. The numbers are shocking, too. According to the study, if you bought the average-priced home in…

- The mid-90s? You could be sitting on over $400,000 in equity now.

- The early 2000s? You could have over $330,000, even with owning during the housing crash.

- In 2015? Even in that shorter 10-year time frame, many homeowners have already built nearly $285,000 in equity.

Of course, your actual number is going to vary based on the purchase price, any work you’ve done to the house, the size of your original down payment, and more. The point is…

Of course, your actual number is going to vary based on the purchase price, any work you’ve done to the house, the size of your original down payment, and more. The point is…

A lot of homeowners are sitting on hundreds of thousands of dollars in equity without even realizing it.

Your Equity Could Power Your Next Move

Here’s where this becomes really important. That equity can offset nearly every concern you have about moving right now.

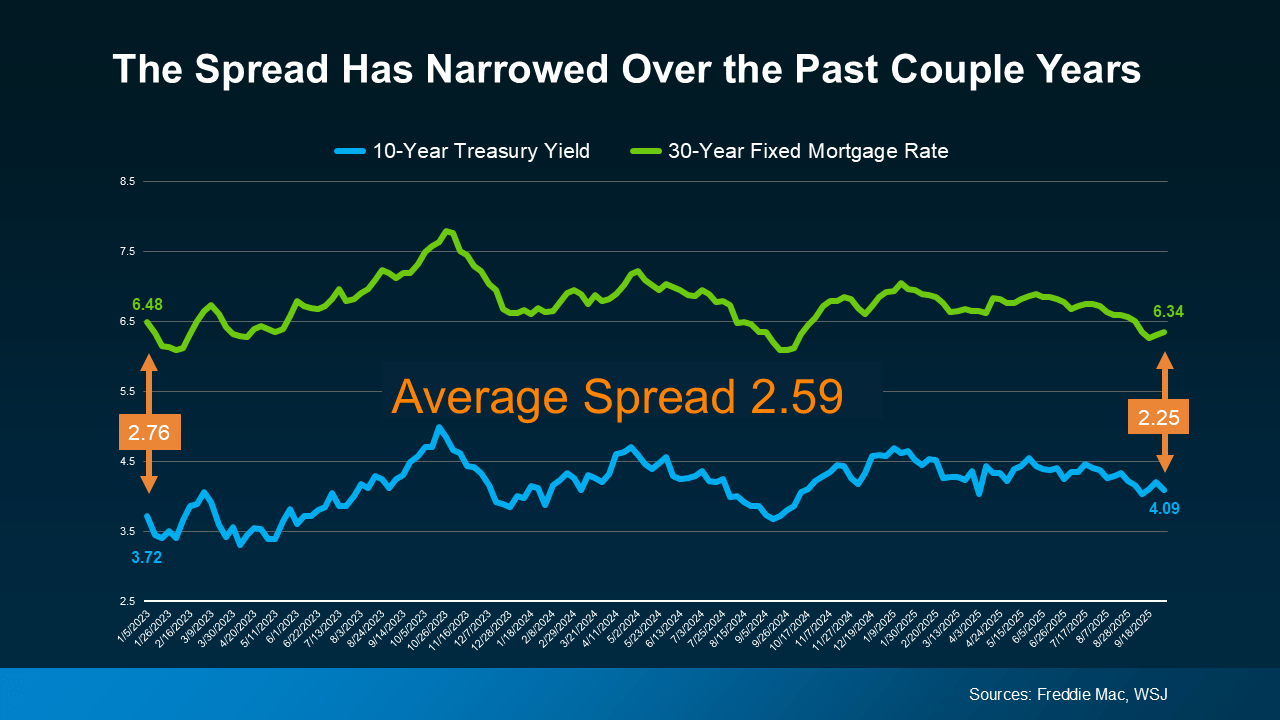

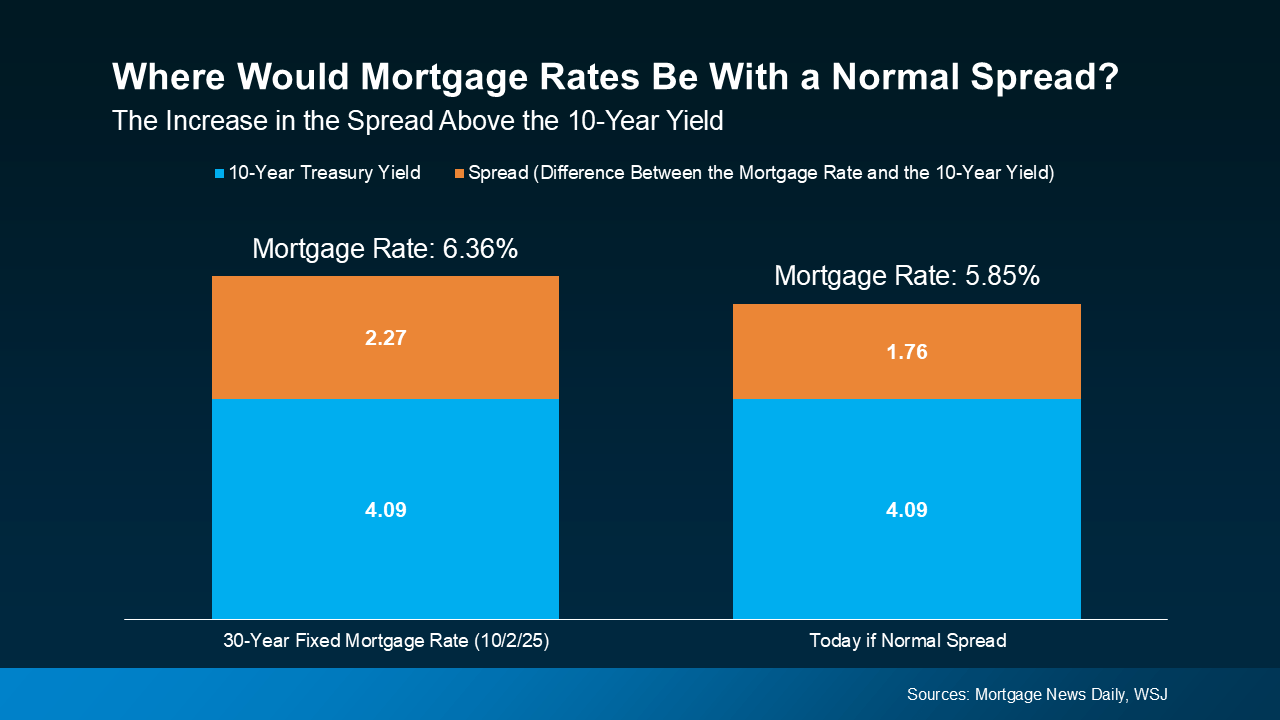

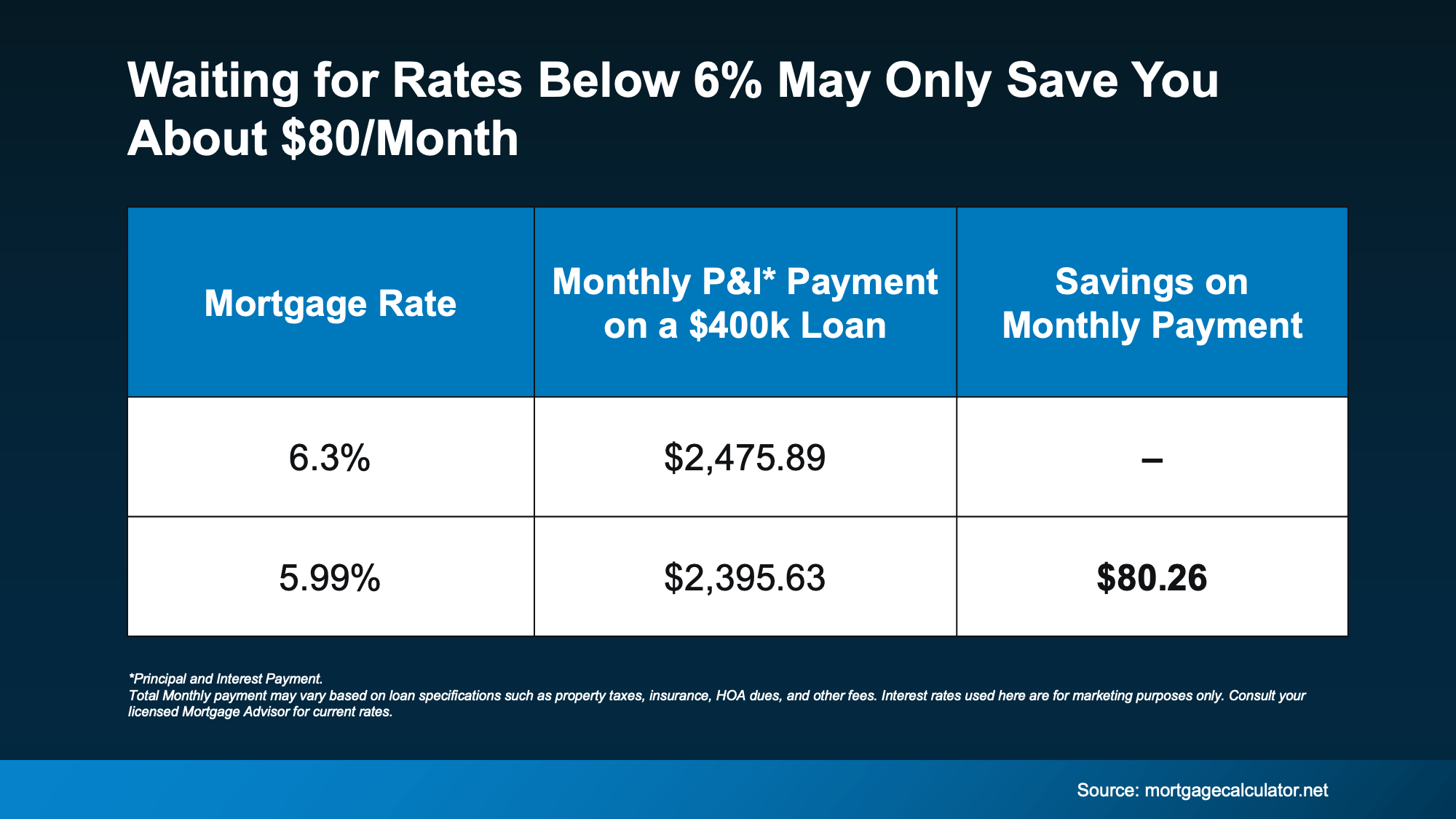

- Worried about taking on a higher mortgage rate? Your equity could cover a significant down payment. And the more money you put down, the less you need to finance at today’s rates.

- Unsure if you can compete in today’s market? Thanks to your equity, you may be able to buy your next house in cash. And an all-cash offer is something that’s going to appeal to a lot of sellers because they don’t have to worry about their buyer’s financing falling through at the last second.

Bottom Line

If you haven’t had someone help you understand the value of your home this year, now’s the perfect time to take another look. It doesn’t mean you have to sell. But it does mean you’ll at least know what you could be working with – and how far that number can take you.

If you want a custom professional equity assessment, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Zillow sums it up best:

Zillow sums it up best:

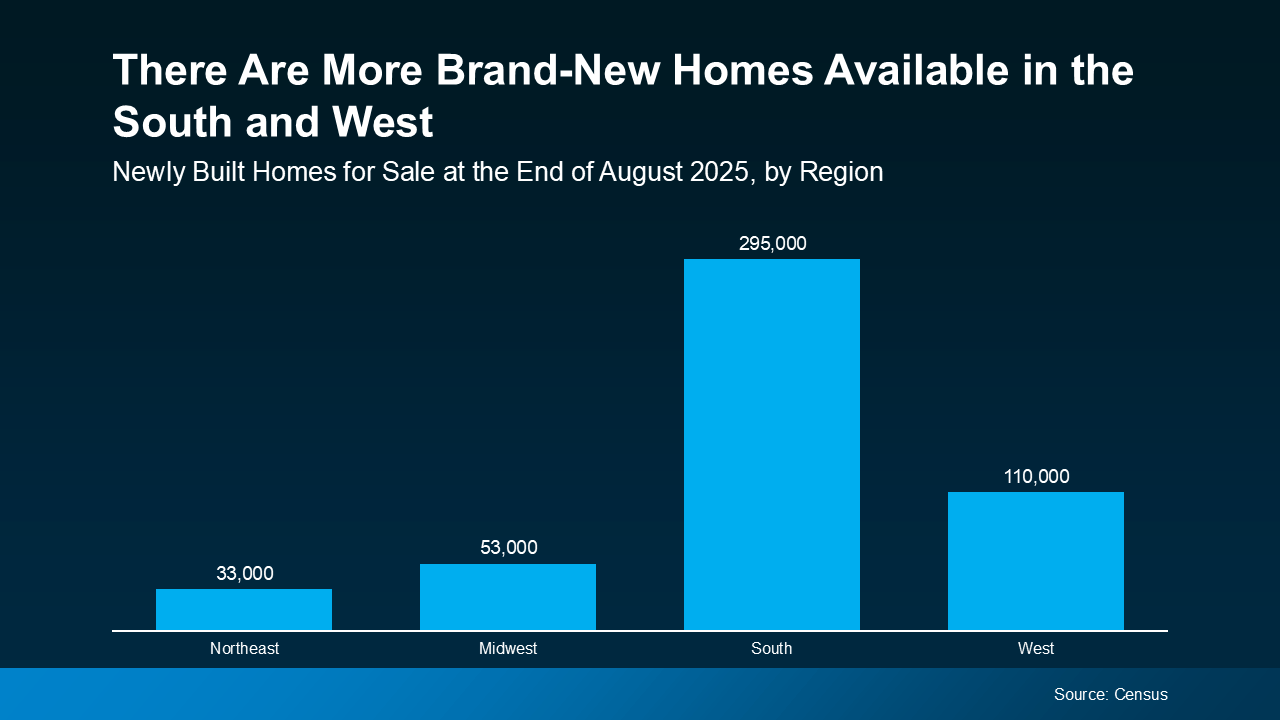

Why Builders Are Throwing in Perks

Why Builders Are Throwing in Perks